Financial Planning Basics are crucial aspect of managing personal finances. It involves creating a roadmap for your financial future, focusing on achieving various financial goals. This process encompasses everything from budgeting and saving to investing and debt management. In this article, we’ll explore the basics of financial planning, particularly for beginners, and delve into the steps involved in creating a robust financial plan. Our aim is to enhance your financial literacy and provide practical tips for effective money management.

Table of Contents

The Fundamentals of Financial Planning Basics

Understanding a financial plan is the first step towards achieving financial stability and success. Here’s what you need to know:

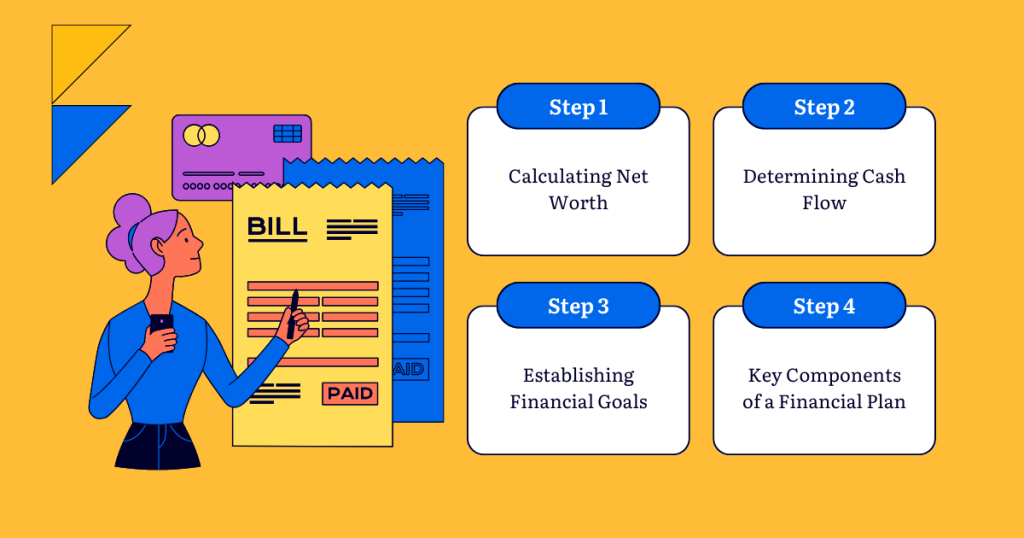

- Calculating Net Worth: Your net worth is the cornerstone of financial planning. It’s the difference between your assets (what you own) and liabilities (what you owe). Knowing your net worth gives you a clear picture of your financial standing.

- Determining Cash Flow: Cash flow analysis involves tracking the inflow and outflow of money. It helps in understanding how much money you’re earning versus spending, which is essential for effective budgeting.

- Establishing Financial Goals: Setting clear, achievable goals is fundamental. Whether it’s saving for retirement, buying a home, or paying off debt, your financial goals will guide your planning efforts.

- Key Components of a Financial Plan: A comprehensive financial plan includes budgeting, saving, investing, debt management, retirement planning, and estate planning. Each component plays a vital role in your overall financial health.

Steps in Creating a Financial Plan

Creating a financial plan can seem daunting, especially for beginners. However, by breaking it down into manageable steps, it becomes much more approachable:

- Gathering Financial Information: Start by collecting all your financial data, including bank statements, investment records, and debts. This information forms the basis of your plan.

- Setting Financial Goals: Define what you want to achieve financially. This could range from short-term objectives like saving for a vacation to long-term goals like planning for retirement.

- Tracking Your Money and Budgeting: Use budgeting tools or apps to track your spending. Budgeting helps in managing your finances effectively and is a key step in financial planning basics for families and individuals alike. For insights on budgeting and tracking finances, consider resources like NerdWallet’s Step-by-Step Financial Planning.

- Planning for Emergencies: Building an emergency fund is essential. It ensures you have financial support during unforeseen circumstances.

- Tackling High-Interest Debt: Paying off high-interest debts, such as credit card balances, should be a priority. It reduces financial burden and frees up more money for savings and investments.

- Planning for Retirement: Retirement planning is a critical aspect of financial planning basics. It involves setting aside funds to ensure a comfortable life post-retirement. For comprehensive strategies on retirement planning, Investopedia’s Financial Planning Guide offers valuable information.

- Tax Planning Strategies: Effective tax planning can help in reducing tax liabilities and maximizing savings. It’s an integral part of a financial plan, especially for those in higher income brackets.

Advanced Financial Planning Strategies

Delving deeper into financial planning basics, there are several advanced strategies that can significantly enhance your financial well-being:

- Investment Planning: This involves creating a diversified investment portfolio tailored to your risk tolerance and financial goals. Consider various investment vehicles like stocks, bonds, mutual funds, and real estate.

- Risk Management and Insurance: Protecting your assets and income against unforeseen events is crucial. This includes obtaining appropriate insurance coverage such as life, health, disability, and property insurance.

- Estate Planning: Essential for ensuring your assets are distributed according to your wishes after your passing. It involves creating wills, trusts, and designating beneficiaries.

- Monitoring and Adjusting Your Financial Plan: Regularly review and adjust your financial plan to reflect changes in your life circumstances, financial goals, and market conditions.

FAQs

What are the 4 basics of financial planning?

The four basics of financial planning are:

- Establishing Financial Goals: Identifying short-term and long-term financial objectives.

- Creating a Budget: Developing a plan for tracking and managing income and expenses.

- Building an Emergency Fund: Setting aside funds for unforeseen financial needs.

- Investment Planning: Allocating resources into various investment vehicles to grow wealth over time.

What are the 5 components of financial planning?

The five key components of financial planning include:

- Income Management: Understanding and organizing your sources of income.

- Investment Management: Strategically investing to increase wealth.

- Expense Management: Tracking and controlling expenditures.

- Risk Management: Protecting wealth through insurance and other means.

- Savings and Retirement Planning: Setting aside funds for future needs and retirement.

What are the 5 steps of financial planning?

The five steps of financial planning are:

- Assessment: Gathering detailed financial information.

- Goal Setting: Defining clear financial goals.

- Creating a Plan: Developing strategies to reach financial goals.

- Execution: Implementing the financial plan.

- Monitoring and Revising: Regularly reviewing and adjusting the plan as needed.

What is the basic concept of financial planning?

The basic concept of financial planning is to manage one’s finances in a way that aligns with personal financial goals and life objectives. It involves understanding your financial situation, setting goals, creating a plan to achieve those goals, and continuously monitoring and adjusting the plan to ensure it remains effective and relevant. Financial planning is not a one-time task but an ongoing process that helps individuals maximize their financial potential and achieve financial security and independence.

Suggestions | Read Now : Saving Money on Everyday Expenses: Top 10 Simple Hacks for 2024

Financial planning is a dynamic and ongoing process that requires attention and adaptation. Whether you’re a young adult, a family, or approaching retirement, the principles of personal finance remain the same: set clear goals, manage your money wisely, and plan for the future. Remember, the journey to financial freedom starts with a single step, and the time to start is now. Embrace these strategies and tips to navigate your financial path with confidence and clarity.